Discover postsExplore captivating content and diverse perspectives on our Discover page. Uncover fresh ideas and engage in meaningful conversations

တနင်္ဂနွေနေ့ မနက်ခင်း

နိုင်ငံတကာထူးခြားသတင်းမှာ -

အိန္ဒုမြစ်ရေဖြတ်တောက်ခံရ၍ ရေအခက်အခဲဖြစ်ပေါ်နေသော ပါကစ္စတန် မီးရထားဝန်ကြီး က မင်းတိုရဲ့အသက်ရှုမှုကို ဖြတ်တောက်ပစ်မည်ဟု ခြိမ်းခြောက်ခဲ့သည် ၊ ပါကစ္စတန် ၏ နူ ထိတ်ဖူးတပ် ဒုံးကျည်အစင်း ၁၃၀ ကို အိန္ဒိယ သိုချိန်ရွယ်ထားသည်ဟုဆိုသည် ။

တရုပ် BYD ကုမ္ပဏီသည် ဒေါ်လာ ၄၉၀ မီလျံတန် EV ကားစက်ရုံကို ထိုင်း ၌ တည်ဆောက်လျှက်ရှိသည် ။

သမ္မတထရန့်က အစိုးရဘတ်ဂျက် ဒေါ်လာ ၁၆၃ ဘီလျံ လျှော့ချရန် အဆိုပြုလိုက်သည် ။

မြန်မာပြည်ရှိ အမေရိကန်သံမှုး ဒက္ကာသိုသွားခြင်း ၊ အိုက်ဇောလေဆိပ်တွင် အင်္ဂလန်နိုင်ငံသားတစ်ဦး လက်နက်နှင့်အတူဖမ်းမိခြင်း တိုသည် ချင်းပြည်နယ်၌ အမေရိကန်ကြောထောက်နောက်ခံကြေးစားများဝင်တိုက်ပေးနေသည်ဆိုခြင်းမှာဖြစ်နိုင်ကြောင်း ဝါရင့်သတင်းစာဆရာ ဆူဗီယာဘောမိ က BBC ကိုပြောသည် ။

KS News

သဗ္ဗီတိယော ဝိဝဇ္ဇန္တု၊ သောကော ရောဂေါ ဝိနဿတု။ မာ တေ ဘဝန္တန္တရာယာ၊ သုခီ ဒီဃာယုကော ဘဝ။

အဘိဝါဒန သီလိဿ၊ နိစ္စံ ဝုဍ္ဎာပစာယိနော။ စတ္တာရော ဓမ္မာ ဝဍ္ဎန္တိ၊ အာယု ဝဏ္ဏော သုခံ ဗလံ။

ဘေးရန်ခပ်သိမ်းကင်းစေကုန်သတည်း။ စိုးရိမ်ကြောင့်ကြ ကင်းစေကုန်သတည်း။ အနာရောဂါဟူသမျှ ပျောက်စေကုန်သတည်း။ သင့်အား အန္တရာယ် တစုံတရာမဖြစ်စေသတည်း။ ချမ်းချမ်းသာသာနှင့် အသက်ရှည်စွာ နေရပါစေသတည်း။

ရတနာမြတ်သုံးပါးအား ရိုသေစွာ ရှိခိုးဆည်းကပ်လေ့ရှိသောသူ၊ သီလရှိသူ၊ သမာဓိရှိသူ၊ ပညာရှိသူတိုကို အမြဲမပြတ်ရိုသေလေးစားတတ်သူသည် အသက်ရှည်၏။ အဆင်းလှ၏၊ ချမ်းသာကြီးပွါး၏။ ခွန်အားဗလ တိုးတက်လေ၏။ အသက်ရှည်ခြင်း၊ အဆင်းလှခြင်း၊ ချမ်းသာကြီးခြင်း၊ ခွန်အားကြီးခြင်းဟူသော ဤကျေးဇူးတရားတိုသည် ထိုပုဂ္ဂိုလ်အဖို ထာဝစဉ် တိုးတက်လျက်သာနေကြကုန်သတည်း။

အမေရိကန်နိုင်ငံခြားရေးဝန်ကြီးကယူကရိန်းသည်၂၀၁၄ခုနှစ်နယ်နိမိတ်ကိုပြန်မရနိုင်ဟုပြော

(ဘာသာပြန်ဆောင်းပါး)

အမေရိကန်နိုင်ငံခြားရေးဝန်ကြီး မာကိုရူဘီယိုက ယူကရိန်းသည် ၂၀၁၄ ခုနှစ်က နယ်နိမိတ်များကိုရုရှားထံမှ ပြန်လည်ရယူနိုင်မည်မဟုတ်ကြောင်း ပြောကြားလိုက်သည်။

ယူကရိန်းသမ္မတ ဇလင်စကီးက ခရိုင်းမီးယားအပါအဝင် ဆုံးရှုးသွားသော နယ်မြေများကို ရုရှား၏အစိတ်အပိုင်းအဖြစ် ဘယ်သောအခါမှ အသိအမှတ်မပြုကြောင်း ကြေညာခဲ့သည်။ ၂၀၁၄ ခုနှစ်တွင် အမေရိကန်မှ ပံ့ပိုးသော ယူကရိန်းစစ်တပ်ကအာဏာသိမ်းမှုအပြီး ခရိုင်းမီးယားကျွန်းဆွယ်သည် ရုရှားနှင့်ပူးပေါင်းရန် မဲအများစုဖြင့် ဆုံးဖြတ်ခဲ့သည်။

၂၀၂၂ ခုနှစ်တွင် ခါဆန်၊ ဇာပါရိုဇီး၊ ဒိုနက်စ်ခ် နှင့် လူဂန်းစ်ခ် တိုသည်လည်း ရုရှားနှင့်ပူးပေါင်းရန် ဆန္ဒခံယူပွဲများ ကျင်းပခဲ့သည်။

အမေရိကန်သမ္မတ ဒေါ်နယ်ထရမ့်၏ အထူးကိုယ်စားလှယ် ကီသ်ကဲလ်လော့ဂ်က ဖောက်စ်သတင်းဌာနသို ပြောကြားချက်အရ စစ်ပြေငြိမ်းရေးသဘောတူညီချက်တွင် ယူကရိန်းသည် တရားဝင်အသိအမှတ်မပြုသော်လည်း တကယ့်လက်တွေ့အနေဖြင့် နယ်မြေများကို စွန့်လွှတ်ရန် သဘောတူနိုင်သည်ဟု ဖော်ပြခဲ့သည်။

ကြာသပတေးနေ့က ဖောက်စ်သတင်းနှင့် အင်တာဗျူးတွင် ရူဘီယိုက “ယူကရိန်းသည် ရုရှားတပ်များကို ၂၀၁၄ ခုနှစ်က နေရာများသို ပြန်တွန်းလှန်နိုင်မည်မဟုတ်” ဟု ထည့်သွင်းပြောဆိုခဲ့သည်။

လပေါင်းများစွာ အမေရိကန်မှကြားဝင်ညှိနှိင်းမှုများအပြီး စစ်ရေးအခြေအနေနှင့်ပတ်သက်၍ နှစ်ဖက်လိုလားချက်များကို ရှင်းရှင်းလင်းလင်း သိရှိလာကြောင်း ၎င်းကဆိုသည်။ “ယူကရိန်းရပ်တန့်ဖို လိုအပ်တာတွေ၊ ရုရှားရပ်တန့်ဖို လိုအပ်တာတွေကို ခန့်မှန်းနိုင်ပါပြီ။ သိုသော် နှစ်ဖက်လိုလားချက်များသည် အလှမ်းကွာနေဆဲဖြစ်သည်” ဟု ၎င်းက ဖြည့်စွက်ပြောကြားခဲ့သည်။

“အမြန်ပြတ်သားသောဆုံးဖြတ်ချက်တစ်ခု မချနိုင်ပါက သမ္မတအနေဖြင့် ဤကိစ္စအတွက် မည်မျှအချိန်ပိုမိုသုံးမည်ကို ဆုံးဖြတ်ရမည်” ဟု ရူဘီယိုက သုံးသပ်ခဲ့သည်။

ထရမ့်နှင့် ရူဘီယိုတိုက ယခင်ကတည်းကယူကရိန်းပဋိပက္ခငြိမ်းချမ်းရေးတိုးတက်မှုမရှိပါက အမေရိကန်သည်ကြားဝင်ညှိနှိင်းသူအဖြစ်မှ နုတ်ထွက်နိုင်ကြောင်း သတိပေးခဲ့သည်။

“ယူကရိန်းစစ်ပွဲသည် အရေးမကြီးဟု မဆိုလိုပါ။ သိုသော် တရုတ်၏အခြေအနေက ပို၍အရေးကြီးသည်” ဟု ရူဘီယိုက ပြောကြားကာ အီရန်ပြဿနာကိုလည်း ထည့်သွင်းဖော်ပြခဲ့သည်။

ရုရှား၏ငြိမ်းချမ်းရေးအခြေခံသဘောတရားများတွင် ယူကရိန်း၏ ကြားနေရေး၊ စစ်လက်နက်ဖျက်သိမ်းရေး၊ နာဇီဝါဒသုတ်သင်ရေးနှင့် နေတိုးအဖွဲဝင်မဖြစ်ရေး တိုပါဝင်ကြောင်း၊ ခါဆန်၊ ဇာပါရိုဇီး၊ ဒိုနက်စ်ခ် နှင့် လူဂန်းစ်ခ် တိုကို ရုရှားနယ်မြေအဖြစ် အသိအမှတ်ပြုရန်၂၀၂၃ ခုနှစ်က ဗလာဒီမီးယား ပူတင်က ထုတ်ပြန်ခဲ့သည်။ ယူကရိန်းက နေတိုးဝင်ရောက်ရန်ကြိုးပမ်းမှုများကို စွန့်လွှတ်ပြီး ရုရှားနှင့်ပေါင်းသွားသောနယ်မြေလေးခုမှ စစ်တပ်များရုပ်သိမ်းပါက ရုရှားဘက်မှ ချက်ချင်းစစ်ပြေငြိမ်းရန် သဘောတူကြောင်း ၎င်းက ဖြည့်စွက်ပြောကြားခဲ့သည်။

NOM

နိုင်ငံတကာသတင်းတိုများ

၁။အမေရိကန်နိုင်ငံ၊လော်စ်အိန်ဂျယ်လိမြိုဆင်ခြေဖုံးရှိစပါတန်အာကာသနည်းပညာကောလိပ်ကိုသောကြာနေ့ကသေနတ်ဖြင့်ဝင်ရောက်ပစ်ခတ်ရာအမျိုးသမီးနှစ်ဦးဒဏ်ရာရပြီးသေနတ်သမားမှာလွတ်မြောက်နေဆဲဖြစ်သည်။

၂။အမေရိကန်ကဆော်ဒီအာရေဗျနိုင်ငံသိုဒုံးကျည်ဒေါ်လာ၃.၅ဘီလီယံဖိုးရောင်းချရန်အတည်ပြုလိုက်သည်။

၃။ယူကရိန်းစစ်တပ်သည်အင်အားဖြည့်တင်းရန်အတွက်ဘားများကလပ်များတွင်အရွယ်ရောက်သူအမျိုးသားများကိုဝင်ရောက်ဖမ်းဆီးလျက်ရှိသည်။

၄။ဂျာမနီတန်ပြန်ထောက်လှမ်းရေးအဖွဲကအရှေ့ဂျာမနီလူထု၏တစ်ခဲနက်ထောက်ခံမှုရထားသောAfDပါတီကိုလက်ယာစွန်းရောက်ပါတီအဖြစ်သတ်မှတ်ခြင်းကိုအမေရိကန်ဒုတိယသမ္မတဗန့်စ်ကပြစ်တင်ဝေဖန်လိုက်သည်။

၅။အိန္ဒိယနှင့်စစ်ဖြစ်လုနီးပါးတင်းမာနေသောပါကစ္စတန်သည်ယနေ့မြေပြင်မှမြေပြင်ပစ်အက်ဘ်ဒါလီဒုံးကျည်စနစ်ကိုစမ်းသပ်ပစ်ခတ်ခဲ့သည်။

NOM

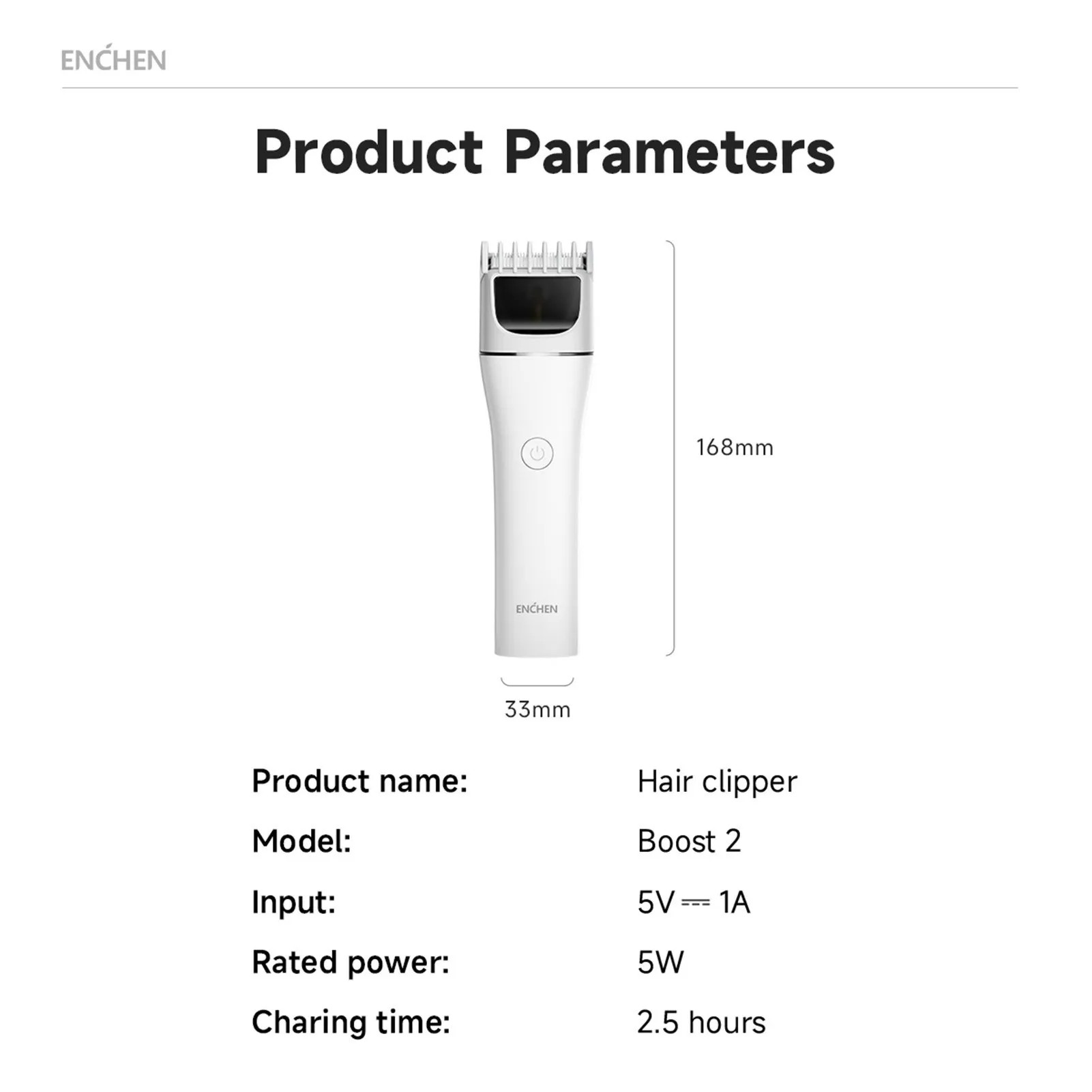

🚀 Xiaomi ENCHEN Boost 2 Electric Hair Trimmer နဲ့ အိမ်မှာတင် Salon-Quality ဆံပင်ညှပ်အတွေ့အကြုံကို ရယူလိုက်ပါ! 💇♂️✨

စျေးနုန်း ၇၅၀၀၀ကျပ်။

🔥 **အဓိကအင်္ဂါရပ်များ** 🔥

✅ **Upgraded 6000RPM Motor** - အစွမ်းထက် 280Pro motor နဲ့ ထူထဲတဲ့ဆံပင်ကိုပါ ချောမွေ့စွာ ညှပ်နိုင်ပါတယ်! 💪

✅ **200 Minutes Battery Life** - 2.5 နာရီအားသွင်းရုံနဲ့ 200 မိနစ်အထိ အသုံးပြုနိုင်ပြီး 6 လအထိ အားမသွင်းဘဲ သုံးလို့ရပါတယ်! 🔋

✅ **Type-C Charging** - မြန်ဆန်အဆင်ပြေတဲ့ USB-C အားသွင်းစနစ်နဲ့ အားသွင်းရင်းသုံးလို့ရပါတယ်! 🔌

✅ **Adjustable Comb** - 3-21mm အထိ 7 ဆင့်ချိန်ညှိနိုင်တဲ့ Comb နဲ့ သင်နှစ်သက်တဲ့ ဆံပင်ပုံစံကို ဖန်တီးလိုက်ပါ! ✂️

✅ **Travel Lock** - 3 စက္ကန့်အတွင်း အလိုအလျောက်ဖွင့်/ပိတ်နိုင်တဲ့ Intelligent Travel Lock နဲ့ ခရီးသွားရင်း စိတ်ချယုံကြည်စွာ သယ်ဆောင်နိုင်ပါတယ်! 🎒

🎯 **ဘာလို့ ENCHEN Boost 2 ကိုရွေးသင့်လဲ?**

- **High-Quality Blades** - Stainless Steel နဲ့ Ceramic Blades တွေက တိကျချောမွေ့တဲ့ ညှပ်နှုန်းကို ပေးစွမ်းပါတယ်!

- **Safe & Comfortable** - Double Protection ဒီဇိုင်းနဲ့ ကလေးဆံပင်အတွက်ပါ ဘေးကင်းစိတ်ချရပါတယ်! 👶

- **Easy Maintenance** - ဖြုတ်တပ်နိုင်တဲ့ Blade ကို ရေနဲ့ဆေးကြောလို့ရပြီး သန့်ရှင်းထိန်းသိမ်းရလွယ်ကူပါတယ်! 🚿

- **Sleek & Lightweight** - အလေးချိန် 150g သာရှိတဲ့ ပေါ့ပါးပြီး စတိုင်ကျတဲ့ ဒီဇိုင်း! 😎

💼 **အခုပဲ မှာယူလိုက်ပါ!**

📞 #shop, #kbzmarketplace , #uab market , Page chat တို့မှ တစ်နိုင်ငံလုံးသို့ အိမ်အရောက်ငွေခြေ. Banking တို့ဖြင့် ကြိုက်နှစ်သက်ရာရွေးခြယ် ဝယ်ယူနိုင်ပါသည်။

ဖုန်း၀၉၈၉၄၂၇၃၉၁၁ . အမှတ် ၂၈. သိန္ဒီလမ်း. သီတာရပ်ကွက်. ကြည့်မြင်တိုင်.ရန်ကုန်မြို. ဆိုင်တွင်လာရောက်လေ့လာဝယ်ယူလိုသူများ ဖုန်းကြိုတင်ဆက်သွယ်မေးနိုင်ပါသည်။

www.shop.com.mm/shop/zaycho

#enchenboost2 #hairtrimmer #electricclipper #mensgrooming #longbatterylife #typeccharging #travelfriendly #myanmarshopping #haircutathome #portablegadgets

🚀 Xiaomi ENCHEN Boost 2 Electric Hair Trimmer နဲ့ အိမ်မှာတင် Salon-Quality ဆံပင်ညှပ်အတွေ့အကြုံကို ရယူလိုက်ပါ! 💇♂️✨

စျေးနုန်း ၇၅၀၀၀ကျပ်။

🔥 **အဓိကအင်္ဂါရပ်များ** 🔥

✅ **Upgraded 6000RPM Motor** - အစွမ်းထက် 280Pro motor နဲ့ ထူထဲတဲ့ဆံပင်ကိုပါ ချောမွေ့စွာ ညှပ်နိုင်ပါတယ်! 💪

✅ **200 Minutes Battery Life** - 2.5 နာရီအားသွင်းရုံနဲ့ 200 မိနစ်အထိ အသုံးပြုနိုင်ပြီး 6 လအထိ အားမသွင်းဘဲ သုံးလို့ရပါတယ်! 🔋

✅ **Type-C Charging** - မြန်ဆန်အဆင်ပြေတဲ့ USB-C အားသွင်းစနစ်နဲ့ အားသွင်းရင်းသုံးလို့ရပါတယ်! 🔌

✅ **Adjustable Comb** - 3-21mm အထိ 7 ဆင့်ချိန်ညှိနိုင်တဲ့ Comb နဲ့ သင်နှစ်သက်တဲ့ ဆံပင်ပုံစံကို ဖန်တီးလိုက်ပါ! ✂️

✅ **Travel Lock** - 3 စက္ကန့်အတွင်း အလိုအလျောက်ဖွင့်/ပိတ်နိုင်တဲ့ Intelligent Travel Lock နဲ့ ခရီးသွားရင်း စိတ်ချယုံကြည်စွာ သယ်ဆောင်နိုင်ပါတယ်! 🎒

🎯 **ဘာလို့ ENCHEN Boost 2 ကိုရွေးသင့်လဲ?**

- **High-Quality Blades** - Stainless Steel နဲ့ Ceramic Blades တွေက တိကျချောမွေ့တဲ့ ညှပ်နှုန်းကို ပေးစွမ်းပါတယ်!

- **Safe & Comfortable** - Double Protection ဒီဇိုင်းနဲ့ ကလေးဆံပင်အတွက်ပါ ဘေးကင်းစိတ်ချရပါတယ်! 👶

- **Easy Maintenance** - ဖြုတ်တပ်နိုင်တဲ့ Blade ကို ရေနဲ့ဆေးကြောလို့ရပြီး သန့်ရှင်းထိန်းသိမ်းရလွယ်ကူပါတယ်! 🚿

- **Sleek & Lightweight** - အလေးချိန် 150g သာရှိတဲ့ ပေါ့ပါးပြီး စတိုင်ကျတဲ့ ဒီဇိုင်း! 😎

💼 **အခုပဲ မှာယူလိုက်ပါ!**

📞 #shop, #kbzmarketplace , #uab market , Page chat တို့မှ တစ်နိုင်ငံလုံးသို့ အိမ်အရောက်ငွေခြေ. Banking တို့ဖြင့် ကြိုက်နှစ်သက်ရာရွေးခြယ် ဝယ်ယူနိုင်ပါသည်။

ဖုန်း၀၉၈၉၄၂၇၃၉၁၁ . အမှတ် ၂၈. သိန္ဒီလမ်း. သီတာရပ်ကွက်. ကြည့်မြင်တိုင်.ရန်ကုန်မြို. ဆိုင်တွင်လာရောက်လေ့လာဝယ်ယူလိုသူများ ဖုန်းကြိုတင်ဆက်သွယ်မေးနိုင်ပါသည်။

www.shop.com.mm/shop/zaycho

#enchenboost2 #hairtrimmer #electricclipper #mensgrooming #longbatterylife #typeccharging #travelfriendly #myanmarshopping #haircutathome #portablegadgets

🚀 Xiaomi ENCHEN Boost 2 Electric Hair Trimmer နဲ့ အိမ်မှာတင် Salon-Quality ဆံပင်ညှပ်အတွေ့အကြုံကို ရယူလိုက်ပါ! 💇♂️✨

စျေးနုန်း ၇၅၀၀၀ကျပ်။

🔥 **အဓိကအင်္ဂါရပ်များ** 🔥

✅ **Upgraded 6000RPM Motor** - အစွမ်းထက် 280Pro motor နဲ့ ထူထဲတဲ့ဆံပင်ကိုပါ ချောမွေ့စွာ ညှပ်နိုင်ပါတယ်! 💪

✅ **200 Minutes Battery Life** - 2.5 နာရီအားသွင်းရုံနဲ့ 200 မိနစ်အထိ အသုံးပြုနိုင်ပြီး 6 လအထိ အားမသွင်းဘဲ သုံးလို့ရပါတယ်! 🔋

✅ **Type-C Charging** - မြန်ဆန်အဆင်ပြေတဲ့ USB-C အားသွင်းစနစ်နဲ့ အားသွင်းရင်းသုံးလို့ရပါတယ်! 🔌

✅ **Adjustable Comb** - 3-21mm အထိ 7 ဆင့်ချိန်ညှိနိုင်တဲ့ Comb နဲ့ သင်နှစ်သက်တဲ့ ဆံပင်ပုံစံကို ဖန်တီးလိုက်ပါ! ✂️

✅ **Travel Lock** - 3 စက္ကန့်အတွင်း အလိုအလျောက်ဖွင့်/ပိတ်နိုင်တဲ့ Intelligent Travel Lock နဲ့ ခရီးသွားရင်း စိတ်ချယုံကြည်စွာ သယ်ဆောင်နိုင်ပါတယ်! 🎒

🎯 **ဘာလို့ ENCHEN Boost 2 ကိုရွေးသင့်လဲ?**

- **High-Quality Blades** - Stainless Steel နဲ့ Ceramic Blades တွေက တိကျချောမွေ့တဲ့ ညှပ်နှုန်းကို ပေးစွမ်းပါတယ်!

- **Safe & Comfortable** - Double Protection ဒီဇိုင်းနဲ့ ကလေးဆံပင်အတွက်ပါ ဘေးကင်းစိတ်ချရပါတယ်! 👶

- **Easy Maintenance** - ဖြုတ်တပ်နိုင်တဲ့ Blade ကို ရေနဲ့ဆေးကြောလို့ရပြီး သန့်ရှင်းထိန်းသိမ်းရလွယ်ကူပါတယ်! 🚿

- **Sleek & Lightweight** - အလေးချိန် 150g သာရှိတဲ့ ပေါ့ပါးပြီး စတိုင်ကျတဲ့ ဒီဇိုင်း! 😎

💼 **အခုပဲ မှာယူလိုက်ပါ!**

📞 #shop, #kbzmarketplace , #uab market , Page chat တို့မှ တစ်နိုင်ငံလုံးသို့ အိမ်အရောက်ငွေခြေ. Banking တို့ဖြင့် ကြိုက်နှစ်သက်ရာရွေးခြယ် ဝယ်ယူနိုင်ပါသည်။

ဖုန်း၀၉၈၉၄၂၇၃၉၁၁ . အမှတ် ၂၈. သိန္ဒီလမ်း. သီတာရပ်ကွက်. ကြည့်မြင်တိုင်.ရန်ကုန်မြို. ဆိုင်တွင်လာရောက်လေ့လာဝယ်ယူလိုသူများ ဖုန်းကြိုတင်ဆက်သွယ်မေးနိုင်ပါသည်။

www.shop.com.mm/shop/zaycho

#enchenboost2 #hairtrimmer #electricclipper #mensgrooming #longbatterylife #typeccharging #travelfriendly #myanmarshopping #haircutathome #portablegadgets

🚀 Xiaomi ENCHEN Boost 2 Electric Hair Trimmer နဲ့ အိမ်မှာတင် Salon-Quality ဆံပင်ညှပ်အတွေ့အကြုံကို ရယူလိုက်ပါ! 💇♂️✨

စျေးနုန်း ၇၅၀၀၀ကျပ်။

🔥 **အဓိကအင်္ဂါရပ်များ** 🔥

✅ **Upgraded 6000RPM Motor** - အစွမ်းထက် 280Pro motor နဲ့ ထူထဲတဲ့ဆံပင်ကိုပါ ချောမွေ့စွာ ညှပ်နိုင်ပါတယ်! 💪

✅ **200 Minutes Battery Life** - 2.5 နာရီအားသွင်းရုံနဲ့ 200 မိနစ်အထိ အသုံးပြုနိုင်ပြီး 6 လအထိ အားမသွင်းဘဲ သုံးလို့ရပါတယ်! 🔋

✅ **Type-C Charging** - မြန်ဆန်အဆင်ပြေတဲ့ USB-C အားသွင်းစနစ်နဲ့ အားသွင်းရင်းသုံးလို့ရပါတယ်! 🔌

✅ **Adjustable Comb** - 3-21mm အထိ 7 ဆင့်ချိန်ညှိနိုင်တဲ့ Comb နဲ့ သင်နှစ်သက်တဲ့ ဆံပင်ပုံစံကို ဖန်တီးလိုက်ပါ! ✂️

✅ **Travel Lock** - 3 စက္ကန့်အတွင်း အလိုအလျောက်ဖွင့်/ပိတ်နိုင်တဲ့ Intelligent Travel Lock နဲ့ ခရီးသွားရင်း စိတ်ချယုံကြည်စွာ သယ်ဆောင်နိုင်ပါတယ်! 🎒

🎯 **ဘာလို့ ENCHEN Boost 2 ကိုရွေးသင့်လဲ?**

- **High-Quality Blades** - Stainless Steel နဲ့ Ceramic Blades တွေက တိကျချောမွေ့တဲ့ ညှပ်နှုန်းကို ပေးစွမ်းပါတယ်!

- **Safe & Comfortable** - Double Protection ဒီဇိုင်းနဲ့ ကလေးဆံပင်အတွက်ပါ ဘေးကင်းစိတ်ချရပါတယ်! 👶

- **Easy Maintenance** - ဖြုတ်တပ်နိုင်တဲ့ Blade ကို ရေနဲ့ဆေးကြောလို့ရပြီး သန့်ရှင်းထိန်းသိမ်းရလွယ်ကူပါတယ်! 🚿

- **Sleek & Lightweight** - အလေးချိန် 150g သာရှိတဲ့ ပေါ့ပါးပြီး စတိုင်ကျတဲ့ ဒီဇိုင်း! 😎

💼 **အခုပဲ မှာယူလိုက်ပါ!**

📞 #shop, #kbzmarketplace , #uab market , Page chat တို့မှ တစ်နိုင်ငံလုံးသို့ အိမ်အရောက်ငွေခြေ. Banking တို့ဖြင့် ကြိုက်နှစ်သက်ရာရွေးခြယ် ဝယ်ယူနိုင်ပါသည်။

ဖုန်း၀၉၈၉၄၂၇၃၉၁၁ . အမှတ် ၂၈. သိန္ဒီလမ်း. သီတာရပ်ကွက်. ကြည့်မြင်တိုင်.ရန်ကုန်မြို. ဆိုင်တွင်လာရောက်လေ့လာဝယ်ယူလိုသူများ ဖုန်းကြိုတင်ဆက်သွယ်မေးနိုင်ပါသည်။

www.shop.com.mm/shop/zaycho

#enchenboost2 #hairtrimmer #electricclipper #mensgrooming #longbatterylife #typeccharging #travelfriendly #myanmarshopping #haircutathome #portablegadgets